Economy Watch: Looking Ahead to 2011

by Jock Finlayson

More than a year into the recovery, BC’s economy has bounced back from the recession of 2008-09 and, on some measures, is in reasonably good shape. However, the rebound that began in late 2009 and carried into 2010 has slowed, with the economy downshifting to a more tepid growth trajectory as the year-end approaches.

For many BC industries, the main problem is that external conditions have softened, as the outlook for the global economy has dimmed. The severe financial crisis that accompanied the 2008-09 downturn in North America, Europe and Japan continues to weigh on the expansion. In the United States, the UK and a number of continental European countries, a multi-year process of de-leveraging is unfolding, after a dramatic build-up of debt over the preceding decade. As consumers repair their balance sheets and governments begin to address ballooning budget deficits, this de-leveraging will dampen economic growth in many advanced nations in the years ahead.

Even Canada, for all its advantages, is poised for a degree of de-leveraging, particularly by households (which are carrying a record high level of debt relative to their disposable incomes). With consumers pulling back and exports expected to struggle in the face of weak American economy and a high Canadian dollar, Canada’s economy is destined to disappoint in 2011, with real GDP growth slipping to perhaps 2% before picking up modestly in 2012.

For the next two years, the principal source of strength in the world economy will be China, India and other emerging markets. The shift in the geographic distribution of economic dynamism was highlighted in the International Monetary Fund’s autumn 2010 economic outlook, which foresees developing economies collectively growing by 6.4% in 2011, while the advanced economies as a group eke out a modest gain of 2.2%. Of particular relevance to Western Canada is China: the IMF projects that its economy will expand by 10.5% this year and by 9.6% in 2011. China now ranks as the world’s second largest economy; it is also the world’s biggest exporter and the leading consumer of several raw materials of which Canada is a leading producer. A number of other emerging markets (including India, Indonesia and Brazil) are also growing robustly, thus helping to sustain the global economic recovery.

The ongoing shift in global economic influence will be a key external factor affecting BC – and indeed all of Western Canada – over the next few years. Strong economic growth in China and much of the rest of Asia will lift BC’s exports and boost trade through the Vancouver and Prince Rupert gateways, while a muted recovery in the US will limit gains in overall Canadian export sales. Shipments to the US now account for about half of BC’s merchandise exports, down from two-thirds a few years ago. The good news is that in a North American context, BC is well-positioned to benefit from the sustained growth of Asian economies, both as a supplier of goods in demand in Asia and as Canada’s primary gateway to the Asia-Pacific region.

Still, we expect the overall growth in BC’s exports to be restrained in 2011, as many export-oriented industries – including tourism – battle headwinds in the second leg of recovery. Prices for lumber, natural gas and some other commodities are unlikely to increase appreciably in 2011. At the same time, the Canadian dollar is approaching parity vis-à-vis the US greenback, owing to its recent surge coupled with a global sell-off of US dollar assets.

With the national economy projected to slow in the coming quarters, the Bank of Canada is likely to be in a holding pattern, keeping interest rates low well into next year. This is an important consideration given the heavy debt loads being carried by many BC residents. Continued low interest rates should help financially stretched households manage their debts without having to cut back on spending.

British Columbia’s domestic economy performed relatively well over the past year, boosted by a hefty dose of fiscal stimulus and record low interest rates that spurred a temporary rebound in home sales and home-building. But the recovery in domestic demand is losing steam. Home sales have fallen sharply, pointing to a more subdued pace of residential construction activity in 2011. Following an unusual outright decline in consumer spending in 2009 (when retail sales fell by 4.4%), spending in BC stores has bounced back but is still below pre-recession trends. Data for the past few months indicate that some of the momentum in consumer spending has subsided, in part reflecting softer retail outlays on items relating to home purchases. A negative reading for the Business Council’s most recent quarterly BC Economic Index is further evidence that the economy is decelerating.

As with so many elements of this recovery process, there are concerns about the underlying strength of the labour market. While the job market in Canada is healthier than in the United States, private sector payroll hiring has been quite weak. Recent Statistics Canada employment reports do show a gain in the number of new private sector jobs in BC, which may be an indication that hiring is gaining traction. The unsettled economy together with continued labour market slack suggests modest wage increases in most BC industries in 2011.

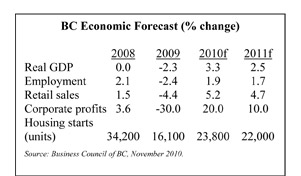

Adding it all up, we envisage a fairly subdued near-term economic outlook for British Columbia. Private sector forecasters have been scaling back their projections for 2011, with most economists now expecting British Columbia’s real GDP to increase in the range of 2.5%. This is consistent with our own forecast, which is summarized in the accompanying table:

Jock Finlayson is the Executive Vice President of the Business Council of BC.