Federal Budget 2011: A Gradual Shift From Stimulus to Restraint

By Jock Finlayson, Executive VP – policy & Ken Peacock, director of economic research, Business Council of BC

The March 22, 2011 Budget presented by Finance Minister Jim Flaherty confirms what was widely expected: the federal government is moving from a period of “fiscal stimulus” to an era of restraint that will bring significantly slower spending growth. The government’s minority status and its desire to garner support from another party is evidenced by the fact the Budget is largely a hold steady affair, with small-scale initiatives directed at a wide range of constituencies and interests. The Finance Minister recognizes the fragile state of the global economy and he includes a number of modest measures designed to support economic growth and job creation.

According to the government, the deficit for this year (2010-11) will come in at $40.5 billion, well below the figure anticipated by many independent analysts, and then decline steadily to reach an essentially balanced position ($-0.3 billion) by 2014-15. Although deficit reduction is a central focus of the Budget, the government does not envision swingeing cuts to program spending. Instead, it proposes to whittle down the deficit by holding the line on expenditures, while revenues are presumed to rise at a reasonable clip over time.

Economic Setting

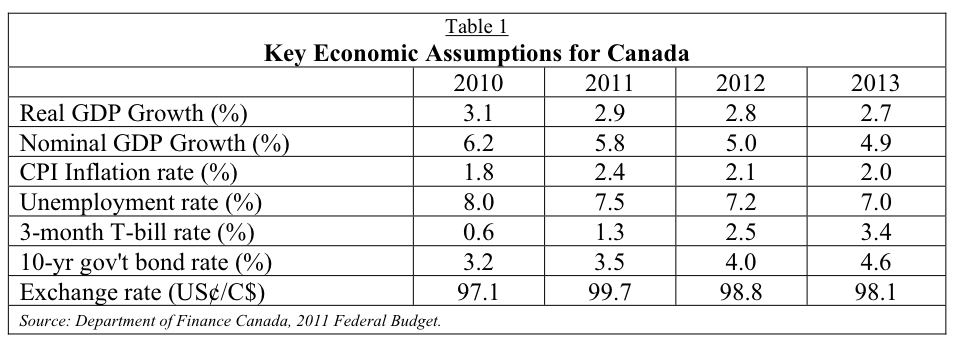

The Canadian economy is on a relatively solid footing, and Canada weathered the past few turbulent years more successfully than many other developed countries. Budget 2011 assumes that the economy (real GDP) will expand by 2.9% this year and by a similar amount in 2012. This projection, based on a survey of private sector forecasters in March, is slightly stronger than the 2.5% consensus growth projection last fall. While a number of headwinds are buffeting the global economy (the disaster in Japan, rising oil prices, the sovereign debt crisis in Europe, and a further decline in US housing), we still judge this to be a prudent national forecast.

There are a number of factors that provide a cushion for the government’s revenue projections. One is that private sector forecasts for nominal GDP growth (which is closely aligned with revenue growth) are on the conservative side, because they are mostly built around a presumption of relatively low commodity prices – despite the likelihood that the global economy will continue to grow by close to 4%. In addition, for budget planning purposes, the government has trimmed the outlook for the level of nominal GDP by $10 billion, which creates a $1.5 billion revenue cushion in each budget year.

Fiscal Picture

The Conservative government says it will essentially balance the budget by 2014-15. Thanks mostly to stronger-than-expected revenue growth, Budget 2011 predicts smaller deficits than what had been expected in last year’s Budget. For the fiscal year ending March 31, 2011, the 2010 Budget pegged the deficit at $49.2 billion, but it will actually come in at slightly more than $40 billion.

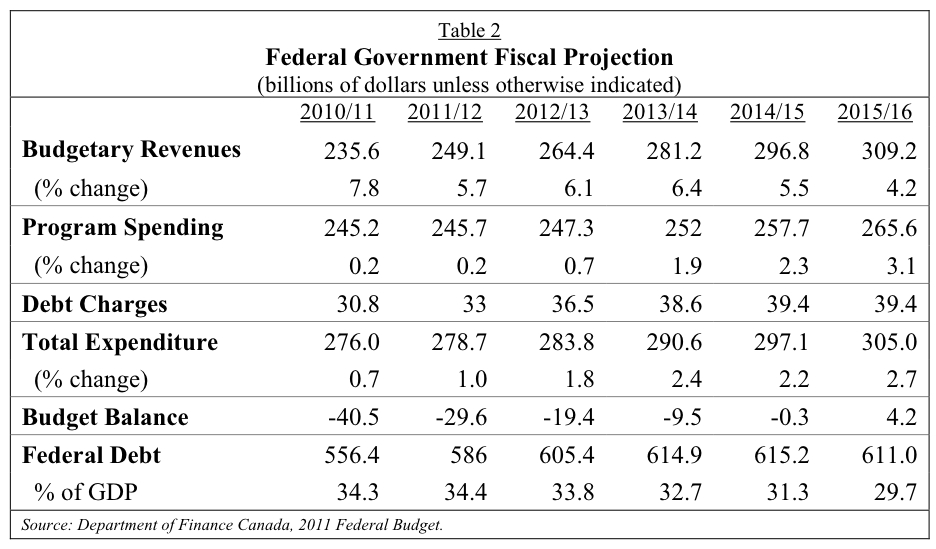

The government plans to hold program spending virtually flat over the next two years, and then to allow modest increases in the final three years of the five-year fiscal plan. While less draconian than outright cuts, the planned expenditure targets do represent real reductions in per capita, inflation-adjusted terms, and we believe it will be challenging to meet the government’s spending targets.

A strategic review of spending was an integral part of the plan to balance the budget over the medium term. The government has completed its strategic review and reports savings of $1.4 billion in the upcoming fiscal year. The savings rise to $2.1 billion next year and then yield annual savings of around $2.8 billion thereafter.

On the other side of the fiscal ledger, the government benefited from a 7.8% jump in revenues for 2010-11. Looking ahead, Mr. Flaherty expects revenue growth to downshift slightly to 5.7% in 2011-12. 250 For the following four years, revenues are projected to increase on average by 5.6% per year, which is consistent with the pattern seen over most of the past  decade. As evident in Figure 1, by the end of the five-year fiscal plan Ottawa’s spending will still be well above where it would have been if past trends had continued and fiscal stimulus had not been ramped up under the Canada Economic Action Plan in 2009.

decade. As evident in Figure 1, by the end of the five-year fiscal plan Ottawa’s spending will still be well above where it would have been if past trends had continued and fiscal stimulus had not been ramped up under the Canada Economic Action Plan in 2009.

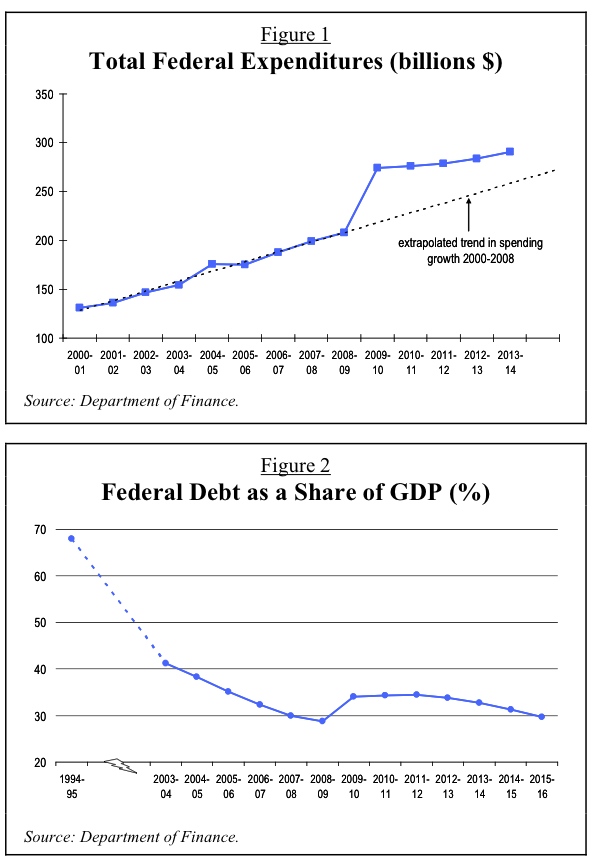

As a result of several years of sizable deficits, the federal government’s accumulated debt rose to $556 billion in 2010-11. With more deficits ahead, the debt is slated to reach $615 billion by 2014-15. While some commentators are concerned about the rising debt, Canada’s overall fiscal position is sound and Ottawa’s debt load is very manageable as a share of GDP. Specifically, the federal debt basically holds steady at 34.4% of GDP next year, it begins to decline in 2012-13, and it returns to 29.7% of GDP in 2015-16, very close to the recent low of 29.0% reached before the recession. Canada is in excellent fiscal shape by international standards, with total public sector debt loads well below many other industrial countries.1

New Budget Measures

Budget 2011 represents a shift away from its spending-heavy predecessors of the previous two years. However, Mr. Flaherty still manages to deliver a host of new small-scale initiatives intended to sustain and promote economic and job growth and appeal to various constituencies and groups. Importantly, the government intends to proceed with the final stage of corporate tax cuts announced in last year’s budget. From our perspective this is a welcome step that helps keep Canada globally competitive for investment and high-value business activity. Academic research confirms that the corporate income tax imposes among the heaviest economic costs of any form of taxation, so it follows that reducing business tax rates should have a substantial positive impact on our economy.2

The Budget contains a number of items aimed at bolstering economic activity. Some of the more significant include:

- An extension of accelerated capital cost allowance treatment for new investment in machinery and equipment in manufacturing and processing sectors for two additional years (to the end of 2013). Allowing companies to write off capital expenditures more quickly will encourage investment.

- A one-time hiring tax credit for small business of up to $1,000, measured against any increase in their EI premiums, for calendar year 2011.

- The permanent elimination of tariffs on machinery and equipment.

- Additional modest funding for post-secondary education, research and innovation.

- An extension to 2012 of the ecoENERGY retrofit program. While primarily intended to improve the energy efficiency of homes in Canada, this measure will help boost activity in the sector.

- Ottawa proposes to legislate $2 billion from the Gas Tax Fund to provide more predictable municipal funding for infrastructure projects.

- BC will benefit from a number of items in the budget:

- $100 million over two years for research, development and demonstrations of clean energy technologies – this measure will be applauded by BC firms in this sector.

- $60 million in 2011-12 to help forestry companies innovate and tap into new market opportunities.

- A move to allow Ridley Terminals Inc. to borrow from the capital markets – this should enable the corporation to proceed with the necessary expansion of its facility.

- A one-year extension of the 15% Mineral Tax Exploration Tax Credit, which is positive news for BC’s mining sector.

- $80 million in funding over three years for the Industrial Research Assistance Program (IRAP) to help small and mid-sized companies accelerate the adoption of information and communication technologies that are important in boosting productivity.

Under that banner of supporting families and communities, Budget 2011 proposes to enhance the Guaranteed Income Supplement for the poorest seniors. This will provide a new top-up benefit of up to $600 annually for single seniors and $840 for couples. The government has launched consultations on the rate-setting mechanism under the Employment Insurance program, with the stated goal being to ensure more predictable and stable rates going forward. Ottawa is also looking to attract more health care workers to rural communities by forgiving up to $40,000 in student loans for doctors and $20,000 for nurses who settle in remote and rural communities.

Conclusion

Budget 2011 contains no major policy changes and is broadly consistent with expectations. From the Business Council’s perspective, a “no surprises” budget makes sense, as the Canadian economy continues to recover amid a still uncertain global setting. We support the plan to return to a balanced budget by mid-decade, and we are encouraged that the government continues to work on stimulating investment, research, innovation, and productivity.

At this stage, it appears the opposition parties will not support the Budget and intend to defeat the Conservative government in Parliament. If that happens there will be a spring election, possibly followed by another Budget later in 2011.