WorksafeBC Premiums Set to Climb

By Jock Finlayson

WorkSafeBC (WSBC) has released its “preliminary” rates for 2013, and it’s fair to say the news isn’t good for most employers. The average base premium rate charged to BC employers is poised to increase by 5 per cent in 2013, reaching $1.62 per $100 of assessable payroll. Note that this marks the first average base rate increase in nine years.

BC’s workers’ compensation system has an impressive record of controlling costs and limiting the rise in employer premiums, compared to the systems in most other provinces and American states. However, after almost a decade of flat/declining base premium rates, many employers are about to experience a sizable jump in workers’ compensation costs – not just in 2013, but likely stretching over several years.

That’s because average premium rates are expected to keep rising, in part due to weaker returns on WSBC’s substantial investment portfolio. WorkSafeBC’s policy is to use any “excess” investment returns to offset a portion of the costs of running the system. When returns decline, there is less money to apply toward costs, forcing the agency to rely more heavily on premiums to fund the system. For reasons that most readers of this report will readily appreciate, WorkSafeBC’s investment returns have deteriorated materially since 2007, reducing the surplus available to help offset claims and operating costs. For 2011, the total return was 4.1 per cent, down from 2009-10, although better than the 8.2 per cent negative return in 2008. WSBC’s practice is to amortize investment gains/losses into premium rates over a five year period, in order to mitigate the short-term impact of sometimes volatile financial market returns. Of interest, the solid investment performance achieved prior to the 2008-09 recession is still helping to dampen premium hikes: for 2013, WorkSafeBC says it will withdraw $203 million from the accumulated reserves built up thanks to prior years’ investment earnings.

Unfortunately, WSBC’s Board of Directors has concluded that the recent pattern of generally poor investment returns will continue, increasing the likelihood of ongoing upward pressure on premiums. While some may quarrel with WSBC’s assessment of the investment outlook, it is consistent with the prevailing sentiment among many leading financial and pension fund managers who have been busy downgrading their investment return projections in the wake of the financial crisis and sub-par recovery from the 2008-09 recession.1 The Canada Pension Plan Investment Board, to take one prominent example, has lowered its targeted annual return to 4 per cent “real,” which equates to an annual nominal return on its total investment portfolio of about 6 per cent. WSBC has adopted a forward-looking investment return assumption that is below 6 per cent.

The current financial turmoil in Europe and sluggish economic recovery in the United States reinforce the view that equity markets are unlikely to rebound strongly in the next few years.2 Also relevant to formulating an informed judgment on investment returns are today’s record-low interest rates and bond yields — which, among other things, support a presumption of low future returns on fixed income assets.

Our judgment is that the investment return projections adopted by WorkSafeBC are prudent but also conservative, and there is a chance that future earnings will be better than it is assuming. If so, this would serve to moderate premium increases beyond 2013. The Business Council will monitor WSBC’s investment performance – and the other factors driving its costs – and incorporate this into our policy advice and advocacy work going forward.

Premium Changes: The Picture Varies by Industry

WorkSafeBC assigns all employers to one of 560 “classification units” – these can be thought of as corresponding to very narrowly-defined industry groups. The 560 classification units are then aggregated into 66 “rate groups,” from which WSBC identifies 24 industry sub-sectors that together make up 7 broader industry sectors.

Employers in the various sub-sectors cover the cost of workplace injuries and diseases affecting workers. The principle is that each specified employer group should cover its own costs. (Note that actual premiums charged to individual employers also depend in part on their own “experience rating” – i.e., their particular claims history.) In any given year, costs for some industry sub-sectors will rise, others will see lower premiums, and a few will experience little or no change.

Overall for 2013, two-thirds of BC employers are expected to face increases in their WSBC industry base rates, 31 per cent will enjoy a decrease, and 4% will see no change. Industry sub-sectors in line for higher premiums next year include banking, universities/colleges, hospitals, hotels/ motels, road construction, homebuilding, trucking, open pit metal mining, metal product manufacturing, electronic product manufacturing, computer consulting, marine terminals, and oil and gas transmission. Those with lower base rates next year include industrial construction, public schools, telephone and cable services, electric utilities, wholesale, engineering consulting, publishing, restaurants, greenhouses, and scientific research laboratories. Among the industry sub-sectors expected to see no material changes to their base rates in 2013 are forestry, airlines & airports, oil & gas production, highway maintenance, insurance services, and heavy equipment manufacturing.

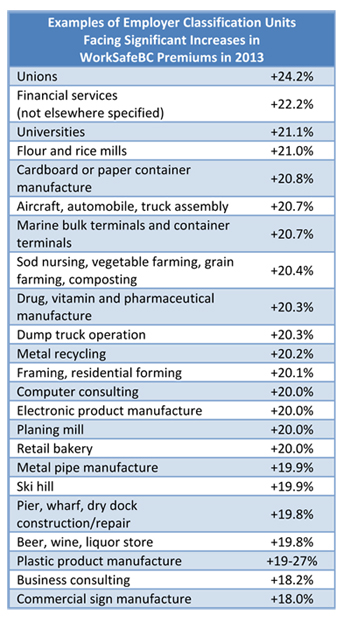

The table below lists some of the individual employer “classification units” facing the biggest WSBC rate increases next year.

Other Factors Impacting Costs

The pattern of rate increases/decreases for 2013 reflects the expected number of WorkSafeBC claims for different industries and classification units, the average cost of claims in these sub-industries, and – as noted above – lower investment returns.

WSBC’s costs, and thus the premiums paid by employers, are also being impacted by several other factors, including mortality improvements and accounting changes mandated by Canadian accounting authorities. Of course, WorkSafeBC’s own policy and regulatory decisions also influence costs — e.g., claims management practices, appeal decisions, and revisions to its occupational health and safety regulations. In addition, the recent provincial legislation (Bill 14) allowing for claims based on “mental stress” is certain to result in higher costs, albeit there is some debate over the magnitude. Some provincial politicians have mused about restoring “lifelong” pensions at WSBC, which would undoubtedly involve another big jump in costs.

All of this underscores the need for the employer community to remain vigilant and engaged with WSBC on policy, regulatory, and operational matters. The Business Council is a member of the Employers’ Health and Safety Association of BC, as we are convinced that collaboration and coordination among employer groups with an interest in workers’ compensation issues can improve the quality and increase the impact of interventions and advocacy by the business community.

1 See for example PIMCO, Investment Outlook (August 2012), available at www.pimco.com.

2 Of interest, the value of the broad US stock market, as proxied by the S&P 500 Index, is currently lower than it was a dozen years ago, after accounting for inflation. Equity markets in Europe and Japan have posted even worse results than the US.

3 The seven broad industry sectors defined by WorkSafeBC are primary resource, manufacturing, construction, transportation and warehousing, trade (retail and wholesale), public sector, and services.

Jock Finlayson is the executive vice president and chief policy officer at the Business Council of British Columbia. jock.finlayson@bcbc.com.

This article was originally published by the Business Council of British Columbia. Questions or comments? Please contact us at info@bcbc.com or 604-684-3384.